In today’s fast-paced financial world, banks are always striving to streamline their operations and optimize efficiency. One crucial aspect of their operations is managing payroll effectively.

Managing payroll in banks involves intricate calculations, adherence to regulatory requirements, and ensuring accurate and timely payments to employees. Traditional manual methods are time-consuming, prone to errors, and can hinder a bank’s growth.

This is where modern payroll software comes to the rescue, automating and streamlining the entire payroll process.

This article aims to explore the top 4 payroll software in Bangladesh used by banks. We will delve into their features, benefits, and how they contribute to enhancing banking processes and productivity.

So, why wait? Let’s dive right into it!

Table of Contents

- Overview of Top 4 Payroll Software in Bangladesh Used By Banks

- 10 Key Factors To Consider When Choosing Payroll Software in Bangladesh

- Final Words

Overview of Top 4 Payroll Software in Bangladesh Used By Banks

In this section, we will discuss the 5 best payroll software in Bangladesh used by banks. Each of these software has some features that may be lucrative for your specific purpose.

So, read each part thoroughly and try to make an informed decision.

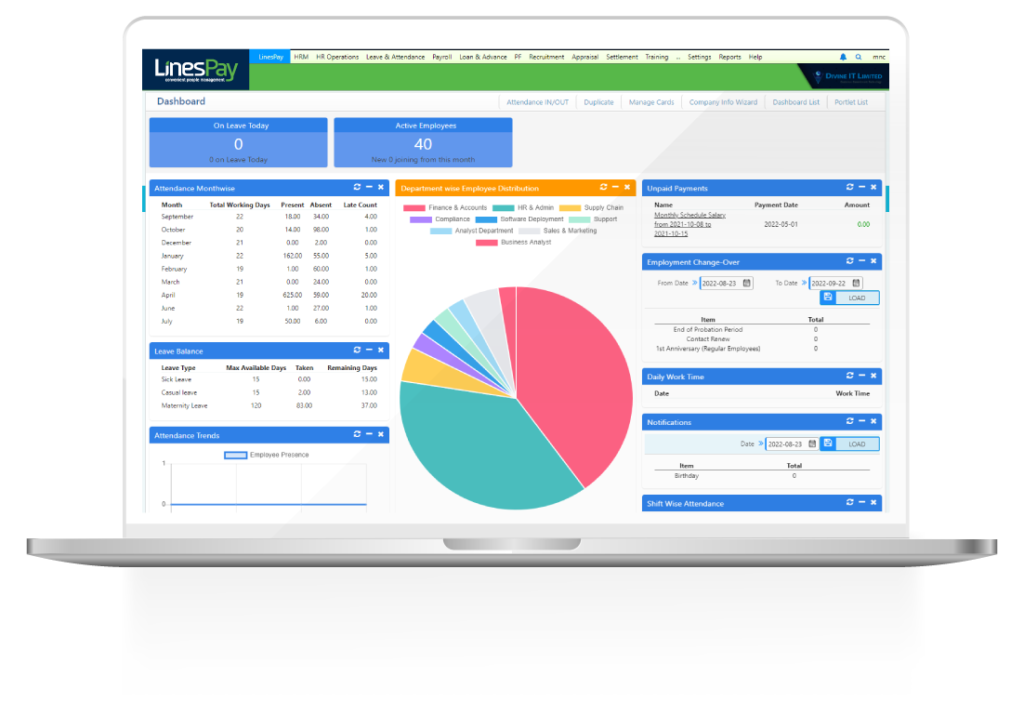

1. LinesPay

When it comes to payroll software used by banks in Bangladesh, LinesPay is one of the leading options worth considering. This robust software offers a range of features and functionalities designed to simplify and streamline the payroll management process.

Some key features of LinesPay are:

Automated Payroll Calculation

LinesPay automates the calculation of employee salaries, including deductions, taxes, and bonuses, ensuring accuracy and reducing manual errors.

Leave and Attendance Management

The software provides comprehensive leave and attendance tracking, allowing banks to efficiently manage employee time off and ensure accurate payroll calculations.

Tax Compliance

LinesPay incorporates the latest tax regulations and ensures compliance, helping banks stay up-to-date with changing tax laws and avoiding penalties.

Employee Self-Service Portal

With the self-service portal, employees can access their payroll information, view payslips, and update personal details, reducing administrative workload for the HR department.

Verdict

LinesPay has gained popularity among banks in Bangladesh due to its user-friendly interface, comprehensive features, and seamless integration capabilities.

By leveraging LinesPay, banks can streamline their payroll management processes, reduce errors, and enhance overall operational efficiency.

2. PiHR

PiHR is an integrated HR and payroll software that offers a wide range of features to meet the diverse needs of banks. It serves as a centralized platform where banks can efficiently manage their HR processes, including employee information, attendance, leave management, and payroll calculations.

With PiHR, banks can automate time-consuming tasks and optimize their HR and payroll operations. PiHR stands out as a comprehensive solution that not only handles HR functions but also excels in payroll management.

Let’s take a closer look at what makes PiHR a top choice for banks in the country.

Payroll Management

PiHR streamlines the entire payroll process, from salary calculations and deductions to tax compliance. Banks can easily generate accurate pay slips, handle different compensation structures, and ensure compliance with banking regulations.

Employee Benefits Administration

PiHR simplifies the administration of employee benefits such as insurance, provident funds, and bonuses. It allows banks to efficiently manage and track these benefits, ensuring timely and accurate disbursement.

Performance Evaluation

Banks can leverage PiHR’s performance evaluation module to assess employee performance, set goals, and track progress. This helps in aligning individual goals with organizational objectives and promoting a performance-driven culture within the bank.

Verdict

PiHR offers a comprehensive HR and payroll solution tailored to the unique needs of banks.

Its advanced features, including payroll management, employee benefits administration, and performance evaluation, empower banks to optimize their HR processes and drive organizational success.

3. PeopleDesk

PeopleDesk is a comprehensive HR management system that encompasses various HR functions, including payroll management.

It offers a user-friendly interface and a wide array of features designed to simplify and streamline HR processes in banks. From employee on boarding and leave management to payroll calculations and reporting, PeopleDesk covers it all.

Let’s discuss some of the top features of PeopleDesk:

Automated Payroll Processing

PeopleDesk automates the entire payroll process, from salary calculations to tax deductions and reimbursements. This automation eliminates manual errors and ensures accurate and timely payroll disbursements for bank employees.

Tax Compliance and Reporting

With PeopleDesk, banks can stay compliant with tax regulations by automatically calculating and deducting the appropriate taxes from employee salaries. The software generates tax reports and forms, simplifying the tax filing process for banks.

Leave and Attendance Integration

PeopleDesk integrates leave and attendance management, allowing banks to seamlessly incorporate attendance data into payroll calculations. This integration ensures that payroll is accurately adjusted based on employee attendance records.

Scalability

PeopleDesk is designed to cater to banks of varying sizes, from small local banks to large national or international financial institutions. The software offers scalability, enabling banks to adapt and grow without worrying about outgrowing their payroll system.

Moreover, PeopleDesk provides customization options, allowing banks to tailor the software to their specific requirements and incorporate any unique payroll policies or workflows.

Verdict

The combination of robust payroll management features, tax compliance capabilities, and scalability makes PeopleDesk a valuable asset for banks in Bangladesh.

By utilizing PeopleDesk, banks can streamline their payroll processes, reduce administrative burdens, and ensure accurate and compliant payroll operations.

4. JibikaPlexus

JibikaPlexus is an advanced Human Resource Information System (HRIS) software designed to streamline Payroll and HR operations in banks.

It provides a centralized platform where banks can manage their HR-related tasks, such as employee data, attendance, performance tracking, and payroll management.

JibikaPlexus is known for its user-friendly interface and robust functionalities that simplify complex HR processes.

Some mentionable features of JibikaPlexus are:

Efficient HR Operations

JibikaPlexus automates various HR tasks, including payroll management, employee record-keeping, and performance evaluations.

By reducing manual effort and streamlining processes, JibikaPlexus enables banks to achieve higher efficiency in managing their HR functions.

Accurate Payroll Management

JibikaPlexus offers comprehensive payroll management features that ensure accurate calculations, tax compliance, and timely salary disbursements.

Banks can rely on JibikaPlexus to handle complex payroll calculations, deductions, and generate error-free pay slips for their employees.

Data Security and Confidentiality

As banks deal with sensitive employee information, data security is of utmost importance.

JibikaPlexus prioritizes data privacy and offers robust security measures to protect sensitive HR data from unauthorized access or breaches, ensuring that confidential employee information remains secure.

Verdict

By leveraging JibikaPlexus, banks can streamline their HR processes, improve accuracy in payroll management, and ensure data security.

The software’s comprehensive features, combined with its integration capabilities, make it a valuable asset for banks seeking to optimize their HR operations.

10 Key Factors To Consider When Choosing Payroll Software in Bangladesh

We have already established how important payroll software is for smooth operation in banks. So, it’s mandatory that the software performs well for the specific bank.

When selecting payroll software for banks in Bangladesh, there are several important factors to consider:

#1 Feature Set

Assess the specific features and functionalities offered by the payroll software. Consider whether it covers the necessary payroll calculations, tax compliance, leave management, and reporting capabilities required by banks.

#2 Integration

Determine the software’s compatibility and integration capabilities with existing banking systems. Seamless integration ensures smooth data flow and reduces manual data entry, minimizing errors and streamlining processes.

#3 User-Friendliness

Evaluate the software’s user interface and ease of use. A user-friendly payroll system saves time and reduces training efforts for bank employees.

#4 Reporting and Analytics

Look for robust reporting and analytics features that provide insights into payroll data, helping banks make informed decisions and monitor payroll performance.

#5 Support and Training

Consider the level of support and training provided by the software vendor. Prompt assistance and comprehensive training resources can facilitate a smooth implementation and ongoing usage of the payroll software.

#6 Data Security

Ensure that the software adheres to industry-standard data security practices, including encryption, access controls, and regular data backups, to protect employee information from unauthorized access or breaches.

#7 Regulatory Compliance

Verify that the payroll software stays up-to-date with relevant tax regulations, labor laws, and banking regulations in Bangladesh. Compliance features such as tax calculations, statutory reporting, and legal document generation are essential.

#8 Data Privacy

Ensure that the software vendor follows data privacy regulations and provides robust privacy settings to protect employee confidentiality and comply with data protection laws.

#9 Customization

Determine whether the software can be customized to align with bank-specific policies, payroll workflows, and reporting requirements. Flexibility in adapting the software to unique bank needs is crucial for seamless integration with existing processes.

#10 Scalability

Assess whether the payroll software can accommodate the growing needs of the bank as it expands. Scalability ensures that the software can handle increased employee numbers, evolving payroll complexities, and changing regulatory requirements.

Final Words

It is an exciting time for the future of payroll software in the banking sector. As technology continues to evolve, we can expect further advancements in automation, analytics, and integration capabilities.

Payroll software in Bangladesh will continue to play a vital role in enhancing efficiency, accuracy, and compliance within banks, ultimately contributing to a seamless payroll management experience.

By carefully assessing the available options and choosing the most suitable payroll software, banks can optimize their HR processes, improve productivity, and ensure accurate payroll operations.